When you think of Search, you may think of Google, Bing, or Yahoo. All of which are search engines. However, recent data tells us that users are starting their online shopping journey elsewhere.

Yep! You guessed, it’s Amazon. With Walmart closely behind search engines.

According to a study conducted with eMarketer, 61% of US consumers begin their product hunt on Amazon.

Note: Respondents could select multiple options

Original Source: Jungle Scout, “Consumer Trends Report Q3 2022,” Sep 13,2022

Why is this so important?

We've discussed at length how search engine result pages are changing, and organic listings are losing attention. D2C brands are already going to continue climbing an uphill battle to win organic traffic, but if they do not adapt their search strategies to where their consumers are, they will fall further behind.

How might you ask? If your digital shelf is nonexistent or not optimized to its fullest potential on Amazon or Walmart, the brand is missing out on a new share of shoppers that are ready to discover products & purchase who may never make their way to a search engine if they find what they are looking for.

Additionally, Amazon's organic keyword footprint in search engines is increasing, especially on Google. According to SEMRush, Amazon ranks for a total of 78.3M keywords in the US Google Search Results. Often, they are outranking D2C brand sites for non-branded transactional terms and are a close second or third option below D2C brand sites on branded terms. SEMRush estimates Amazon to receive ~600M+ users a month given their organic position and estimated monthly search volume for those keywords.

Pair that with an estimated 93M US Households on Amazon Prime in 2023 with D2C brands revising return and shipping policies due to cost. There may be more perks for a shopper to choose Amazon than the brand site.

Action steps to take:

- Analyze Amazon’s overlap with your domain’s keyword footprint

- Discover what perks your consumer favors when purchasing on site, use those in your messaging within metadata to influence stronger click through rates from the SERP

- Audit your Digital Shelf on key retailer sites and improve your optimizations to rank in SERPs that retailers are prioritized in. This includes:

- Ensuring you’re leveraging the appropriate keyword strategy within your product listing’s titles, descriptions, features, and benefits based on search demand

- Identify duplicate product listing content; for the brand site to reign supreme in the SERPs, separate content should be provided to retail partners, Amazon, Walmart, and the brand site

- Utilizing any backend keywords that are hidden on the Amazon PDP

- Analyze your Voice of Customer data and identify opportunities to incorporate VoC strategy into the PDPs to increase conversion rate

Need help taking action? We’ve done this a time or two before. Let us help.

We’d be remiss to end there.

Where users flock, so do ads.

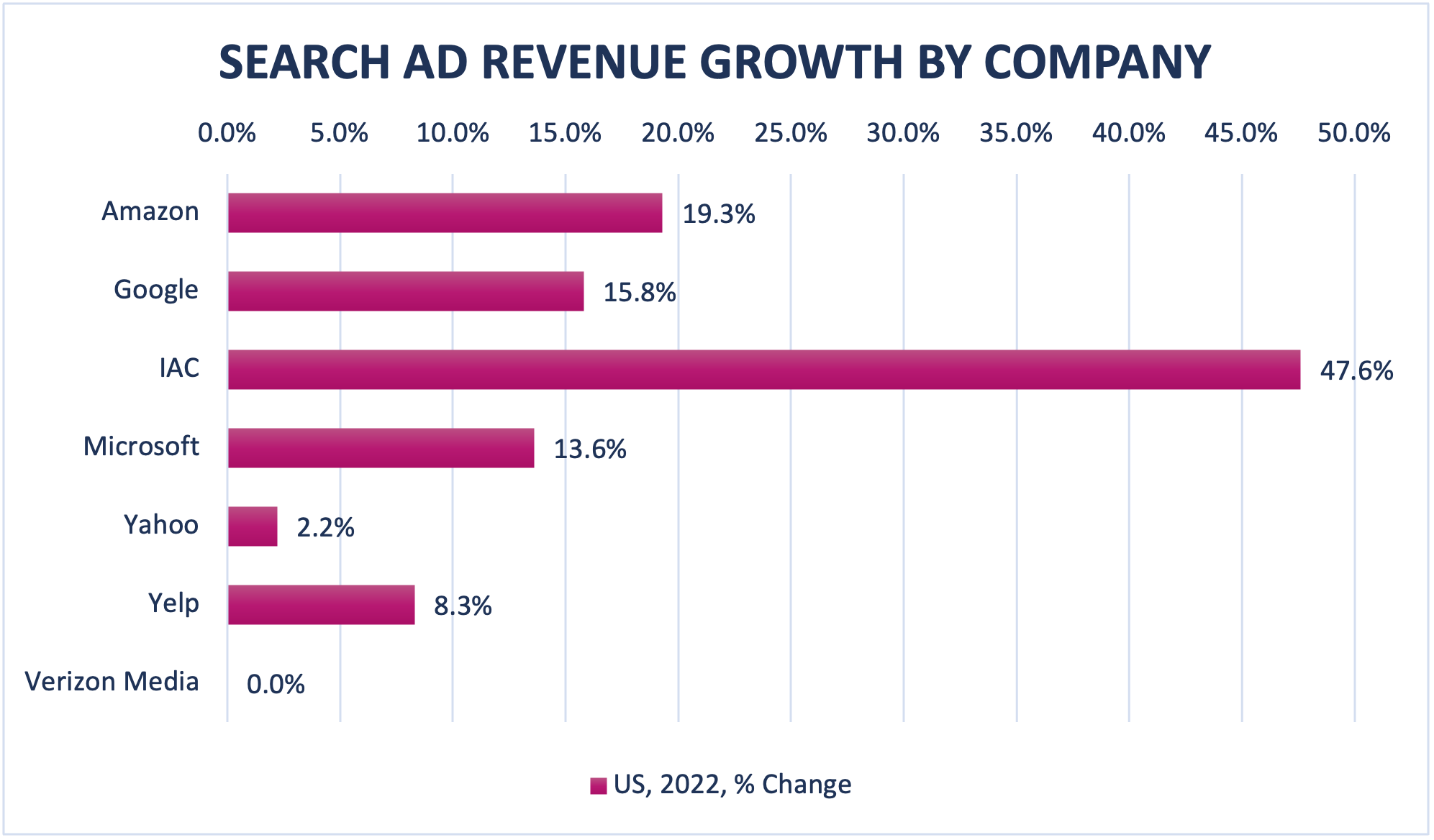

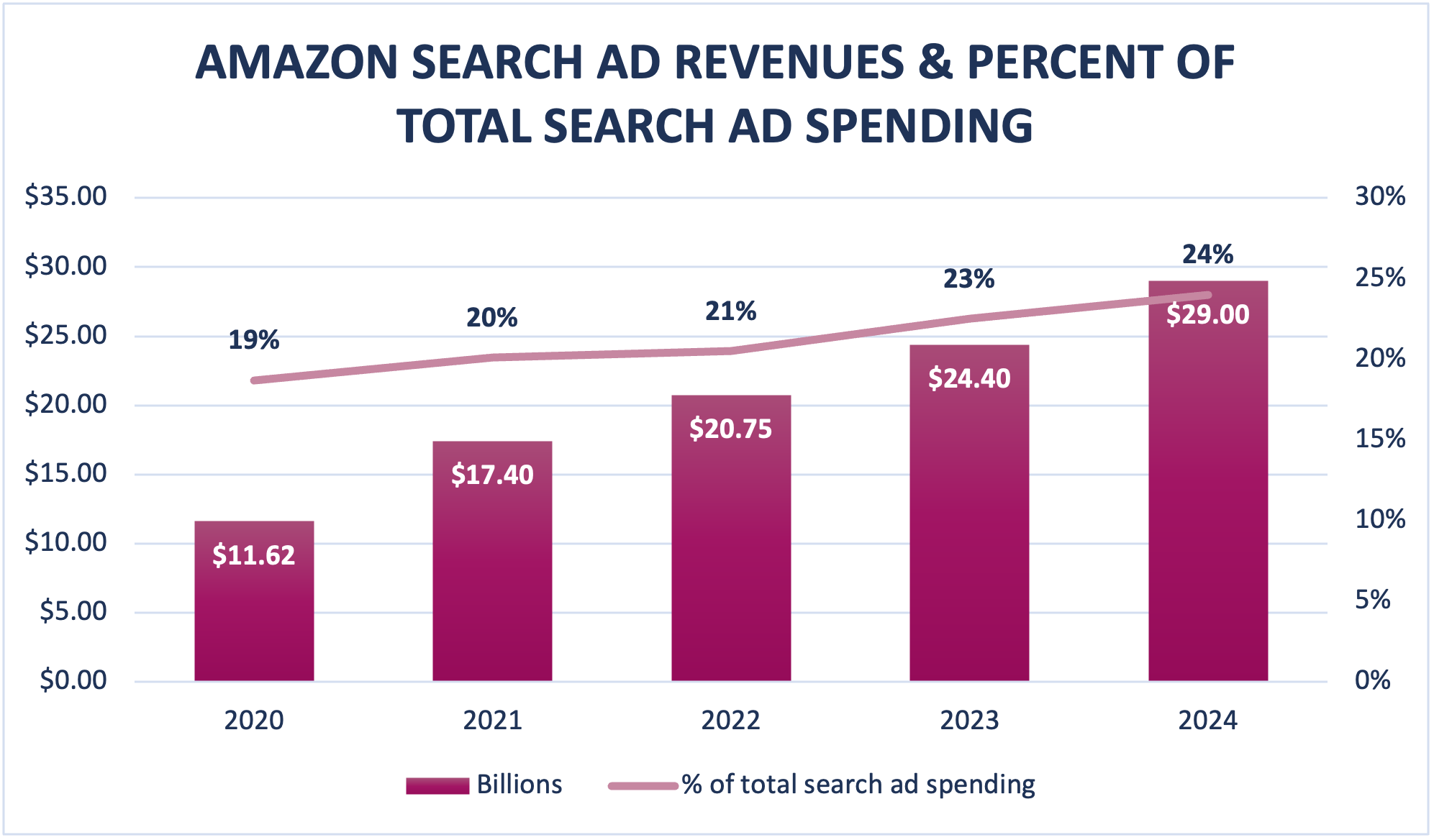

Amazon is capturing more Search ad revenue due to shoppers sometimes solely doing their shopping on the platform. Google remained a leader in Search Ad Revenue in 2022 with $57.22 Billion versus $20.75 Billion on Amazon. But Amazon had a 3.5% growth over the search giant.

Note: Includes advertising that appears on desktop and laptop computers. As well as mobile phones, tablets, and other internet connected devices. Includes contextual text links, paid inclusion, paid listings (paid search), and SEO.

Original Source: eMarketer, October 2022

With all else considered, it only makes sense that Amazon will begin to take over a higher portion of brands Search Advertising budgets. Their marketplaces are becoming equally as competitive as a search engine and using Sponsored Ads to increase brand awareness and conversion volume is critical. Especially during peak moments shopping moments like Prime Day Sales or Cyber 5, where you can effectively continue to remarket to those that visited your product detail pages but never converted.

Note: Includes advertising that appears on desktop and laptop computers. As well as mobile phones, tablets, and other internet connected devices. Net ad revenues after companies pay traffic acquisition costs (TAC) to partner sites. Includes contextual text links, paid inclusion, paid listings (paid search) and SEO.

Original Source: eMarketer, October 2022

Action steps to take:

- Cross-reference top performing keywords on both retailers and search ad platforms like Google and Microsoft Ads

- If Sponsored Ads are not being used, consider testing to remain competitive on the retailer sites

- Adjust ad messaging to address consumer needs to influence click through rates

Ready to take action? Let’s chat.

IDX works with clients across the globe to build & refine their commerce growth and SEO strategies. Get in touch with one of our experts now — we can help get you started!