Social commerce, that felicitous marriage of content and shopping in social media, is picking up steam in the United States. Although China is the undisputed social shopping leader, Influencer Marketing Hub reports the prediction that about 5% of total eCommerce retail sales in the United States will be via social channels by 2025. McKinsey projects U.S. social media e-commerce sales will increase 20% annually to 2025, reaching $80 billion. Numbers like these beg a closer look. What trends do we see for social commerce in 2023? Read on to learn more about our forecast for the coming year:

Social commerce defined

Social commerce means selling goods and services through social media. A social platform such as Instagram or TikTok makes it possible for the shopping experience, mom discovery to purchase, to happen within the app or by linking to a brand’s product display page on a separate site. There are many ways to sell within a social media platform, including buying directly from an ad or post. Sharing compelling content (with or without the help of a social influencer) is essential to making social commerce successful. Here are some trends affecting the uptake of social commerce in 2023.

1. Live shopping will accelerate

According to Insider Intelligence, by the time 2022 ended, there were more than 100 million shoppers buying via social platforms in the United States. And this year, for the first time, more than half of US social network users will make a purchase using social platforms.

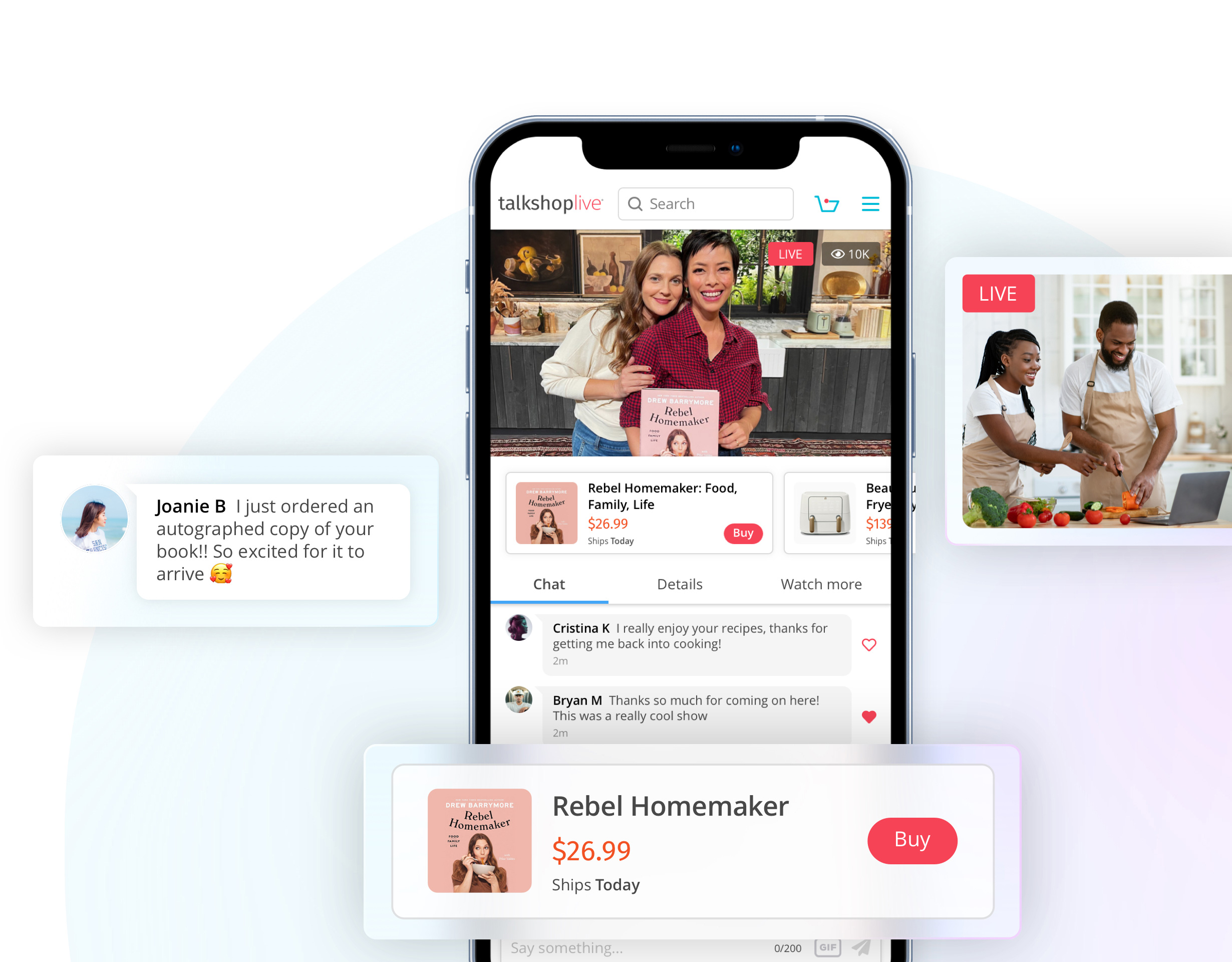

For platforms like TikTok, that’s a powerful incentive to explore live shopping options, and they’ve subsequently started a conversation with TalkShopLive. TikTok hopes that TalkShopLive will provide the technology facilitating live shopping features on TikTok, and an infrastructure that would give creators and brands the opportunity to sell merch through videos on the platform.

Source: TalkShopLive

The plan isn’t foolproof: live shopping remains an uncertain market, as reported in TechCrunch. But if TikTok can make a partnership with TalkShopLive work, the platform can dip a toe in live shopping waters without incurring too much risk (if the gambit proves disappointing, TikTok hasn’t expended too many resources, and pivoting wouldn’t be catastrophic).

The risks notwithstanding, other platforms appear to be acting also. Social Media Today reports that Instagram is experimenting with live-stream shopping; their prediction is that the app may introduce a new tab allowing a full-screen, always-on feed of live shopping content. And businesses like Amazon are building their own live shopping capabilities to stake out their own turf — and compete with TikTok.

2. TikTok to challenge Amazon?

The competition between TikTok and Amazon may escalate even more this year, given TikTok’s plans to build its own product fulfillment centers in the United States. As reported in Axios, new job openings posted to LinkedIn describe an “international e-commerce fulfillment system” including customs clearings and supply chain systems to support eCommerce endeavors in the United States.

Such an eCommerce supply chain system could directly provoke the Amazon empire and boost TikTok profits. The bottom line: TikTok is taking on Amazon. As Axios notes, “TikTok’s meteoric growth . . . has also begun to pose a threat to companies like Amazon and Google that rely on intent-based search advertising to drive business on their shopping platforms.”

To be sure, TikTok faces some headwinds in the United States as legislators scrutinize its privacy practices and concerns about TikTok and national security mount. But meanwhile, advertisers and users show no sign of slowing down their adoption of TikTok.

Amazon is not taking the rise of TikTok lightly. Amazon recently launched its own TikTok-like feed on its e-commerce app, hoping to attract new shoppers through a stream of photos and videos from their favorite influencers. Amazon is under pressure to improve its performance as an eCommerce company following a challenging 2022. We could have a battle royale on our hands between TikTok and Amazon.

3. YouTube will turn shorts into a commerce platform

Shorts, YouTube’s short video feature, is also teeing up as a platform for social commerce. This year, YouTube Shorts has claimed 15 billion views daily, numbers that make Shorts a good candidate for connecting with shoppers. Some brands, like beauty company Glossier, have already sold products through Shorts. In a June 2022 Glossier campaign, for example, approximately 100 influencers received Glossier pencil eyeliner and encouragement to create Shorts videos using the product and the hashtag #WrittenInGlossier. Any Shorts video including the hashtag was shoppable.

YouTube, of course, is feeling the pressure from investors to improve its advertising performance as TikTok eats into its revenue growth. YouTube’s test of in-app shopping features for Shorts is well timed – and needed.

4. The rise of the creator economy will fuel social commerce

The social media content creator economy is exploding, with successful creators like MrBeast demonstrating the power creators can wield. As creators gain an audience, they also generate interest from brands that see the advantage of partnering with an up-and-coming star. And social platforms like Meta and YouTube are invested in helping the two connect, greasing the wheels of commerce by developing revenue-sharing programs (YouTube is set to launch its own revenue sharing program in early 2023). Meanwhile, TikTok has already split ad revenue 50/50 with approved creators through its TikTok Pulse program.

Source: TikTok

Of course, not every creator is the right match for every brand. As in any business relationship, the culture and world views on both sides must mesh well. It’s also important for brands to understand that as a creator gains more followers, something authentic and personal may well be lost in terms of how they connect with their networks.

In short, brands need to understand the dynamics a creator brings to the table and assess whether the match is a win/win.

What brands should do

If social commerce is an opportunity brands really can’t afford to miss out on, it’s not a one-size-fits-all proposition. Savvy advertisers will ask themselves some key questions:

- Who is my audience?

- What social commerce platforms are they on, and when are they on them?

- What is the risk of investing in social commerce?

- What is the upside of investing in social commerce?

- How do I connect my brand most effectively with my audience?

- How do I create an experience strategy that leads to conversions and ROI for my social commerce strategy?

Depending on a brand’s target audience, social commerce may play a bigger (or smaller) role in marketing strategy. Does your user audience skew young? If so, a bigger commitment to social commerce probably makes sense. Bottom line: brands need to meet their audience where they’re at. Savvy brands understand where that is and respond accordingly.

Finally, as stated earlier, there are no guarantees when it comes to the success of social commerce features such as live shopping. Ask yourself: are you prepared to change course if live shopping is a disappointment? How comfortable are you with the potential risks of this brave new world?

Contact IDX

To succeed with social commerce in context of a broader commerce strategy, learn more about our Commerce Solutions or get in touch with one of our experts. We can help you identify opportunities and build upon the areas that are driving the most growth for your business.