You can’t manage what you don’t measure, as Peter Drucker famously said. But when you measure too many things, knowing where to focus your reporting becomes a real challenge -- as anyone in charge of ESG performance reporting can attest.

And unfortunately, focusing on the right ESG metrics is proving to be increasingly difficult because of the proliferation of ESG frameworks, guidelines, and standards in recent years.

Why ESG Standards Exist

ESG standards exist for a good reason. They give companies a way to benchmark their organization against their peers. They provide hard data needed to share their ESG performance with investors, employees, customers, and many other interested parties. Most importantly, ESG standards help keep businesses accountable for doing their part to ensure a sustainable future for the planet.

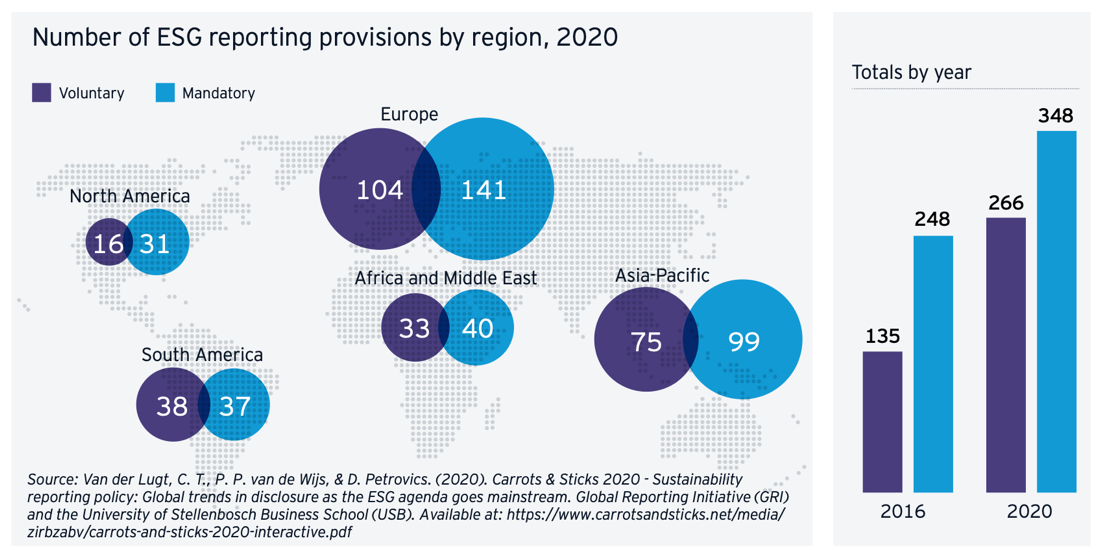

But ESG standards have become an ever-changing maze that is increasingly hard to navigate, both for the companies who are reporting and the audiences which they are trying to reach. According to EY’s The Future of Sustainability Reporting Standards, the number of ESG regulations and standards globally has nearly doubled in the last five years, and there exist 600+ ESG reporting provisions globally, with many having differing interpretations of sustainability.

Source: The Future of Sustainability Reporting Standards, EY

As a result, many companies are now asking themselves whether they are measuring, managing, and reporting on the right things.

The Consequences of Having Too Many ESG Standards

Too many standards creates a disconnect with investors when the focus of the standards being reported against is not aligned with the information that investors are asking for. (According to PWC, only about a third of investors think the quality of reporting they are seeing is good enough.) Even worse, there is a very real risk that businesses are becoming so distracted by managing multiple standards and frameworks that they lose focus on the most material aspects of their impact on the planet.

At Investis Digital, we know of companies who have put a pause on further investment in improving their reporting until the path towards more standardization and alignment is clearer. Fortunately, there are signs of hope. In September 2020, five international framework- and standard-setting institutions – the CDP, CDSB, GRI, IIRC, and SASB -- co-published a shared vision of the elements necessary for more comprehensive corporate reporting and a joint statement of intent to drive towards this goal.

More recently, the International Financial Reporting Standards Foundation announced in 2021 a new International Sustainability Standards Board (ISSB) to develop a comprehensive global baseline of high-quality sustainability disclosure standards to meet investors’ information needs. However, the United States and European Union are taking different approaches to sustainability reporting, as noted in EY’s report.

How Companies Should Navigate the Maze of ESG Standards

How should companies navigate this maze? In fact, the starting point is to look outside the maze. The first question is a company should ask is not “Which reporting standards should we follow?” but “How do we create value for our different stakeholders?” And the challenge becomes communicating that value.

In communicating sustainability matters we find it helpful to frame a narrative around three foundational pillars: transparency, leadership, and connectivity.

- Transparency: the foundation of trust; without trust there is no credibility. All stakeholders understand that sustainability is a journey, and every company would like to be further down the path. Communicate transparently about the most material issues you face, your plans to address them, and your performance against the targets you set. Do so continuously via your website, not just annually in your reporting.

- Leadership: a compelling sustainability narrative needs leadership from the top and leadership by example. Your website and wider digital presence provide the platform for amplifying the voices of your leaders and bringing to life the initiatives that are driving sustainable change in your organisation.

- Connectivity: your sustainability goals can only be achieved when the strategic approach is a fully integrated part of your wider business strategy. And it can only be achieved through working with others within a company’s stakeholder ecosystem. Demonstrating how you are building those connections and integrating your approach are key to successful communications.

Learn More During PR Week

On March 24th, we’re going to discuss this issue with a panel of ESG industry leaders at an event we are hosting in conjunction with PR Week, “Build a sustainable future through the power of comms.”

The panel of ESG and communications experts from Vodafone, Bupa, and Anthesis Group will address key communications issues including:

- How to integrate sustainability in your organisation’s strategy.

- Balancing the demands of different stakeholders to act responsibly

- How best to represent your approach and actions in your communications

- How to navigate the changing landscape of ESG regulations and reporting frameworks.

To learn more about the panel, please register here. Meanwhile, if you need a little TLC – or would just like to talk about sustainability and ESG communications – let us know!