How should Investor relations (IR) professionals communicate with their stakeholders during a recession? A full-blown recession may or may not have arrived yet, but businesses are already in recession mode, and the volatility in capital markets is clear and present. The past few years have certainly prepared IR professionals for recessionary times. Geopolitical instability, the great resignation, soaring inflation, the supply chain shortage, and challenges from the pandemic – they’ve all forced IR to learn how to tame the wild beasts of volatility and uncertainty. The name of the game is to show stability and a path to growth. Here are some tips for building trust during recessionary times:

Do a Pulse Check with Your Audience

Know your investors and know them well. This is always a sound strategy, but during a recession, it’s important to keep close tabs on their sentiment and motivations to maintain their trust. Investor fear about uncertainty can undermine any business, and those two emotions are informing your investors’ decisions during hard times. They are likely probing deeper into your business fundamentals and looking for any sign of weakness that could encourage them to dump your stock. During a recession, IR professionals need to know:

- What are your investors talking about? What specific topics related to your business and industry are driving their conversations?

- Which investors are you most likely to lose, and which ones could potentially do the most damage to your business if you lose them? Know where your greatest areas of risk are so that you can address them.

- On the other hand, where might investors actually be looking to your business to compensate for weaknesses in their portfolio?

- What is the investment style of your audience? Do you have a message tailored for your growth investors versus value investors? Long-term versus short-term? This is important because you need to highlight specific aspects of your outlook statement so that you can message them accordingly.

One way to understand investor sentiment is to study corporate trends through the analysis of their earnings calls and other presentations. According to Aiera, a leading financial event intelligence platform, mentions of “recession” have accelerated meaningfully this earnings season. In fact, “recession” has been mentioned over 4,000 times in over 1,400 global earnings calls just in the first eleven days of August 2022. Those corporations that lead in mentions are as one might expect – in the financial services sector (Goldman Sachs, SoftBank Group, Bank of America, and Wells Fargo), information technology (Apple, Nvidia, and Intel) and consumer discretionary industries like entertainment (Disney), food and beverage (Starbucks), and travel/transportation (Uber).

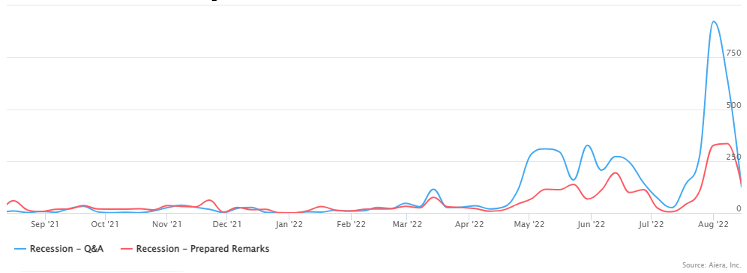

Mentions of “Recession” in Prepared Remarks vs. Q&A

Mentions of “recession” were (and are) up significantly from last quarter’s earnings calls (May-June 2022). According to Conor McDade, Aiera’s Chief Financial Officer, “In particular, we are seeing where mentions of ‘recession’ are most found during analyst Q&A, rather than within management prepared remarks. This suggests that investors are growing increasingly focused on how the current macro backdrop stands to impact corporate earnings.”

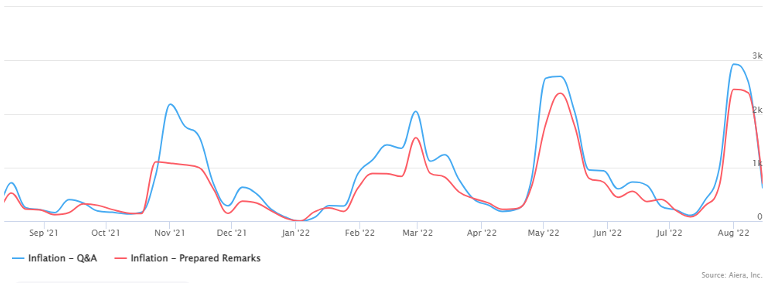

Mentions of “inflation” as a contributing factor to a pending recession continue to be one of the most prevalent topics identified by Aiera’s proprietary natural language processing (NLP). With mentions in the thousands each quarter, it is apparent that management teams are closing the gap from prepared remarks to Q&A – and are now ready and willing to address the topic.

Mentions of “Inflation” in Prepared Remarks vs. Q&A

This data suggests that a proactive approach to addressing recessionary topics in the same way that inflation has been addressed would be advantageous.

By contrast, there is a noticeable decline in mentions of the term “economic recovery” for the past four consecutive quarters, which is well below levels a year ago when management teams were discussing their 3Q21 results amid economies reopening around the world. “Economic recovery” was used mostly as a term to promote confidence and optimism coming out of the COVID-era and the Great Resignation. But few choose those words during the market uncertainty we see today.

Mentions of “Economic Recovery” in Earnings Calls

Keep in mind that the above data pertains to an analysis of a broadly defined set of investors. This can be done for a narrowly defined audience, sector, or industry so that an IR team can understand what investors specifically are saying.

Manage Communications with a Narrative that Builds Trust

A recession is an opportunity for proactive crisis communications. Don’t let the economic narrative control your own narrative. To do that, you need to create a narrative that builds trust. This means being prepared to address the recession head-on on your earnings calls and investor days while demonstrating a path forward to long-term growth. Here are some tips:

- You must address the elephant in the room. Communicate an awareness of the talk on the street and of investor trepidation with the change in economic factors. Plan on mentioning the recession in your Q&A prep on earnings calls (if you are not doing so already). If you need ideas and inspiration, examine the industry earnings transcripts of companies that are weathering the capital markets storm to understand how they are talking with analysts.

- Build credibility by addressing specifics. Address economic factors directly, specifically: how impending interest rate hikes will affect consumer discretionary spending lending, and how that may affect your industry, operations, and stakeholders including investors, board, employees, customers, recruits, and influencers.

- Reiterate past performance: use your COVID response (and those from companies you admire) as a clear indicator of how your company handled previous setbacks and economic uncertainty successfully. If ever there was a time for communicating during uncertainty, the pandemic was (and is) it. Apply what you have learned.

- Look for resilient, recession-proof aspects of the business that investors can trust will pull through recessionary times. Highlight them, and invest in them.

- Discuss ways you are planning for a post-recessionary recovery. How are you investing for long-term innovation and growth, as industry leaders are doing right now?

Adapt How You Operate

History has shown that during a recession, IR professionals have to do more with less. So, evaluate your current IR website and comms provider and your internal team capabilities. Find ways to maximize the value of each, or adjust to optimize the spend in both areas.

- Look for areas of “economic value add” -- channels, partners, and formats where you can save money. Virtual events are a great low-cost alternative for earnings and investor days. They are far less expensive than the traditional expenditures when hosting your own event.

- Pre-record as much earnings and investor day content as possible. This gives you the ability to perfect the message and delivery, especially in uncertain times (leaving the hard questions to in-person or virtual Q&A).

- If you are light on internal team support (or experience consistent bottlenecks), reach out to your vendors/partners to see what else they can do for you. Are there some other support services they can provide? Often they provide more than you are aware of, and are cheaper than hiring a full time resource.

- Run an accessibility audit on your IR and corporate website. With the rise in accessibility lawsuits, the work needed to update your own IR or corporate website is far less than the legal fees to respond to lawsuit threats and demand letters.

- Proactively demonstrate your own fiscal responsibility to your internal stakeholders, including your board. Show how you are helping to cut costs and maximize output with your own efforts (and the ideas listed above).

- Look at areas in your ESG/sustainability plan to improve efficiency, lower costs, or make the business more apt to weather a pending recession. Highlighting those areas of a business that make it more sustainable, for the long term.

Focus on the Long Run

We cannot stress this enough: companies that win go beyond “making it through” the hard times. They look for ways to innovate, and they share those innovations with investors, as noted above. As reported in The Wall Street Journal, “Companies from Google parent Alphabet Inc. to General Motors Co. to PepsiCo Inc. are among those that have increased spending on big-ticket items, such as real estate, equipment or technology, to fuel growth. The investments are generally intended to expand the companies’ fast-growing operations or even optimize their inventory in the midst of a challenging business environment, according to executives.” For instance, Procter & Gamble has been reacting to the supply chain crisis by looking for ways to use technology to innovate.

IR can play an important role by collaborating with senior executives to uncover those growth areas and create a game plan for communicating them to all audiences – from investors to employees. IR can be more strategic than ever.

Contact Investis Digital

At Investis Digital, we help businesses build trust with investors through our own IR/comms practice. Contact us to learn how we can help you.

Thank you to Aiera for providing data and insight for this blog post. For more information on Aiera’s research solution, request a free Aiera consultation today.